Free & Premium Cheat Sheet Set-Ups and Trading Signals for Monday August 8th

Market participants continue to digest the more nuanced aspects of the blow-out BLS jobs number released last Friday morning. As I suspected, sellers wrested control from the bulls on Friday, pulling down the SPX by half a dozen points. However, none of the Market’s Forecast’s junior timeframe oscillators tipped the market in a bearish direction. For those of you who watched last night’s pilot CheatStream episode, I got into a civil debate with ChaikinPowerUser.com’s Double-A, who is a perma-bear, walking him through every shred of available evidence that would point to an impending market reversal and crash to new lows. Nothing there.

I agree with him that a huge piece of inflation data hangs over our heads this week. As Cheat Sheet data has been showing for over a month, the July inflation report is expected to show a much slower pace of price pressure. The month-over-month reading is expected to show a 0.2% increase, down from the 1.3% increase in the prior month. The headline year-over-year number is expected to slow from 9.1% to 8.8%. A hotter than expected num-bah? Look out below Red Sox, the mah-ket is coming to join you in the basement, largely thanks to a 75 basis point hike that would likely be in the cards for September’s FOMC meeting. But, later this week, I’ll show you exactly what to look for in Cheat Sheets ahead of the release. If you‘ve followed me, you know how firm my conviction is that enough big money has access to nonpublic information to make day-before-morning-release price action matter, as in a divining rod. It’ll be part of the premium content, but you can grab a trial free for seven days. This would be a good week to burn that complementary hall pass.

Despite reaching overbought territory with prices pinned at resistance, Near Term oscillators on the major indexes remain bullish and Momentum has stayed in the Neutral zone. I would have expected a harsher close for stocks Friday. The segment of market participants (and I’m among them), convinced that the Fed will aggressively overplay its hand and tighten into a rapidly softening economy, is squawking loudly right now. But enough traders must see a Dovish pivot on the horizon and seem to be positioned for more gains by rotating to under-owned asset classes rather than fading the entire market aggressively.

For those of you new to Cheat Sheets, we only consider buy signals for stocks and ETFs with Tailwind scores above 50%. You can expand these thumbnails, but links to much-easier-on-the-eyes reports are available at the bottom of this post.

I’ll spare you a rehash of my most recent Relative Strength Cheat Sheet deep-dive, but if you read it, you know we searched hard for evidence of an impending sell-off but came up empty. Free and Paid subscribers, it’s in your inbox as of Saturday. So, let’s now examine the evidence on key pre-trade checklists and evaluate the quality of trade set-ups we’re getting.

Once we eliminate trade candidates with Tail Wind % scores below 50, two buy-the-dip signals for sector ETF’s emerge:

Defensive Consumer Staples (XLP) and Healthcare (XLV),

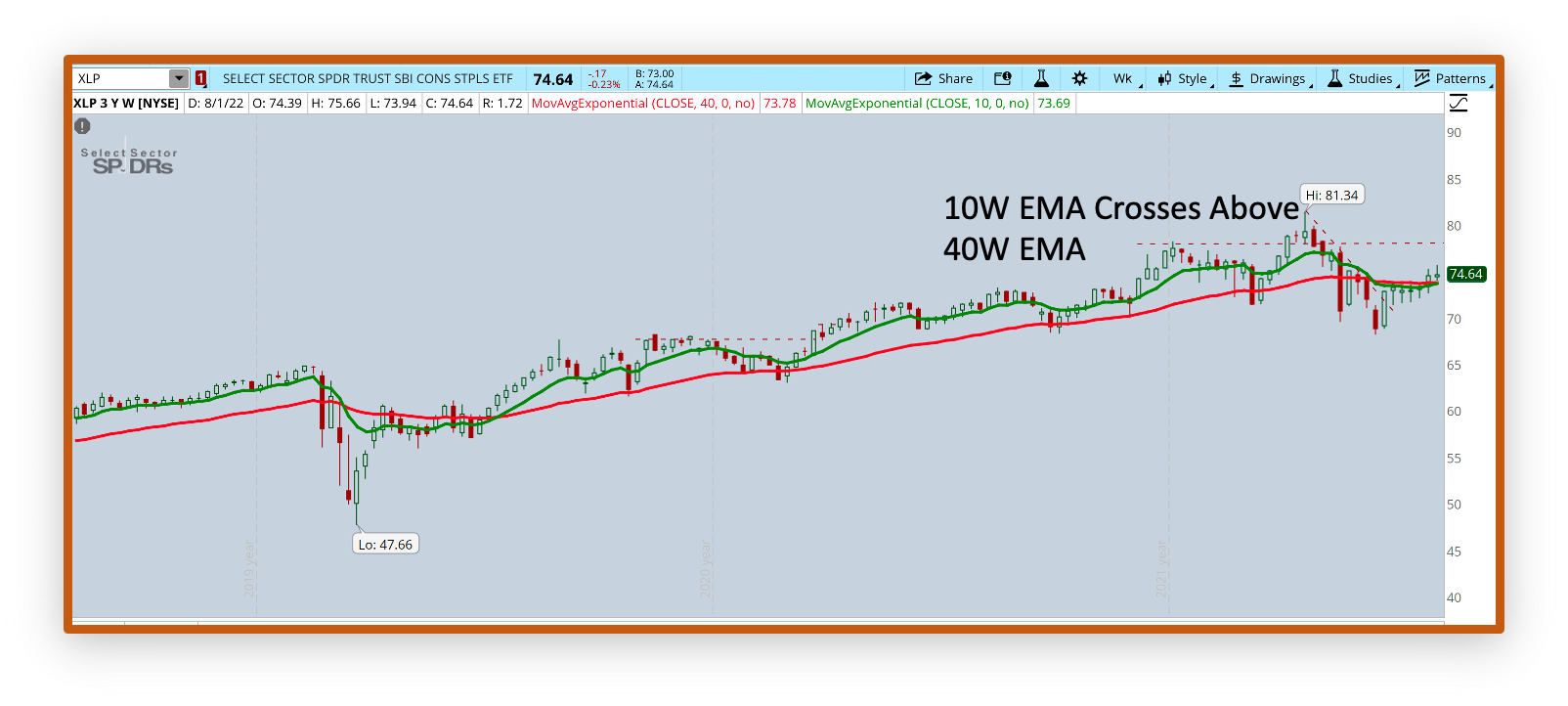

Plus, we are on the cusp of two long-term bullish entry signals for these instruments as well (not valid until Friday at the earliest), Long Term entries happen when the 10-week exponential moving average has crossed above the 40-week EMA. Traders would enter and likely set a stop loss and “trail” it just below the 40-week EMA. Once the price falls below the moving average and breaches our stop, the trade is over. An alternative exit is planned when the moving averages cross back bearishly.

These types of trend trades offer good risk vs. reward potential and are low maintenance. You can see below that the last set of signals was profitable. But, that’s not always the case, as you know.

Acting on today’s buy-the-dip signal, I favor XLP over XLV. Buying pressure for XLP is very bullish and only bullish for XLV. We picked up some relative strength weakness vs. the market on the Healthcare ETF over the past 3 months as well, but the longer time frame is in check. Read the weekend Cheat Sheet RS post for more. These are not going to be high flyers, but they are more likely to survive any Electric Boogaloo sequel to last month’s inflation number.

Our Youtube channel provides a thorough review of buy-the-dip trade entry optimization. Remember, these signals should be a starting point for your own research. I’m the architect of Cheat Sheet, and yet I still vet each qualifying signal.

Note the orange highlights above mean nothing. I’ll get them changed for next time.

Cheat Sheets (TS) Trading Signals - Always Free

Due to a large amount of data, Cheat Sheets can take several seconds to load.

Free (TS) Stacks

Major Indexes- Here

Cheat Sheets (TS) Trading Signals - PREMIUM for Paid Subscribers

For those supporting my work with an annual subscription of $50 or $5 monthly, I hope that you’ll profit early by investigating some of the trade signals below. Nothing would please me more than for you to experience an early win. While I’m not licensed to dispense advice, I will try to share my process as a trader taking the risks of the same market, using these signals.

Buy the Dip on OPCH (in our top S&P 500 Stocks to Watch stack below), a home healthcare service provider and part of XLV, which is in the process of triggering a long-term buy signal and buy-the-dip today. The stock has run up about 10% since its recent earnings announcement. That’s too much. It goes on my bullish watchlist for now, and I’d consider a trade as the stock pulls back to its 21-day exponential moving average. Then, I’d likely initiate a position and trail a stop-loss of 1.6x its 21-day exponential average true trading range, or ATR). That’s a 21-day exponential average of it’s trading range over the past 3.5 trading weeks. We’d trail this stoploss just below the 21-day price exponential moving average. I’d use the indicator “Keltner Channels” to set this up. easily If the stock dips more than 1.6ATR (21 day EMA) below its 21-day price EMA, the trade is over. On your chart, the Kelner Channel rolls up (we hope) proportionally below the 21 price EMA in a parallel path.

Long Term Moving Average Cross. This next stock is also in the S&P 500 Socks to Watch stack and in the healthcare provider space. It’s on my list to consider today. It had a good earnings report. I treat longer-term moving average cross-overs as investments for the long haul rather than trades. I hope to be in this for months, if not a year or more. We’ll see.

Last Friday, the 10-week EMA crossed above the 40-week EMA, confirming a long-term entry. I make sure that no more that 5% of my entire account capital gets allocated to any one investment to control my risk. This stock has a TailWind Score of 58%, including Bullish Buying pressure. A line in the sand could be the 40-week moving average, giving a trader a potentially long-term time frame for being in this stock, which also pays a 2%+ dividend. I’ll probably wait until the close to buy because

Keep reading with a 7-day free trial

Subscribe to Stock Cheat Sheets to keep reading this post and get 7 days of free access to the full post archives.