Now That the Can Has Been Kicked Down the Road & Through Earth's Gravitational Field, Will a "Big Beautiful Bull" Soon Follow?

On Sat July 3, Congress narrowly passed the One Big Beautiful Bill Act, a sweeping Trump-backed tax-cut and budget package. It combines major tax reductions with sizable federal spending in defense, energy, infrastructure and more. Critics warn of soaring deficits and inflation risk; supporters argue the stimulus will ignite a bullish period for growth and markets. Below is a breakdown of trade-offs and, most importantly, the industries and companies likely to gain from the new policy regime.

A Wave of Tax Stimulus (and Some Red Ink)

The bill delivers roughly $3.8 trillion in tax relief over ten years. It makes permanent the 2017 rates, shields overtime pay and tips from federal income tax through 2028, enlarges the standard deduction, sweetens the Child Tax Credit, and relaxes the SALT cap. Businesses regain 100 percent expensing for equipment and R&D and keep the 20 percent small-business income deduction.

The trade-off is a projected $2½–3 trillion deficit surge (more if provisions later extend). Greater debt could push long-term interest rates higher and stoke future inflation. Social program cuts—especially in Medicaid and food stamps—may trim spending power at the lower end of the income scale. Even so, the immediate cash injection is set to lift consumption and investment.

The “Big Beautiful Bill” and a Potential Big Bullish Expansion in Key Industries

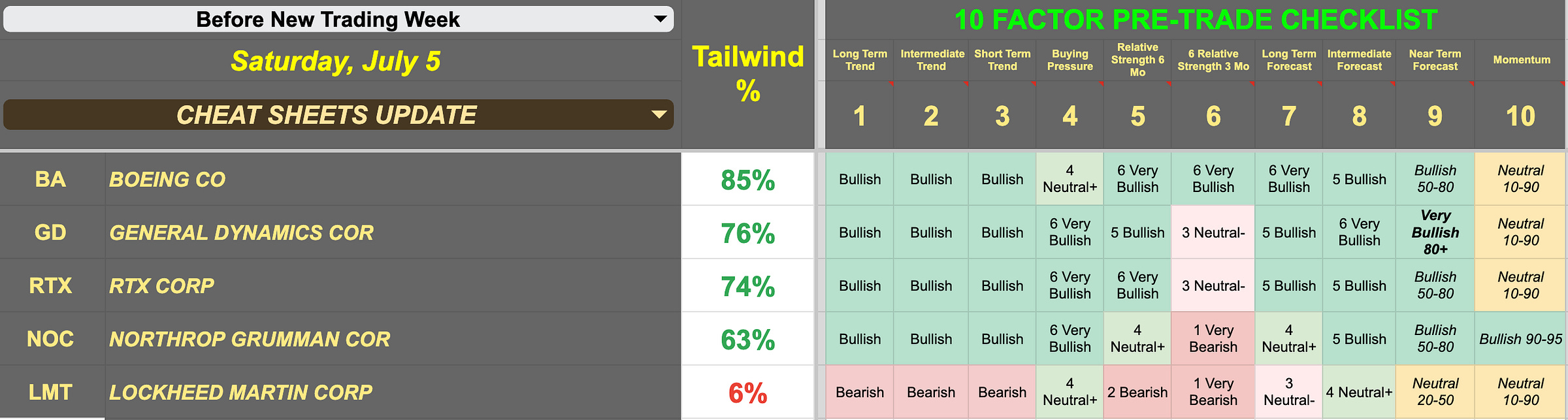

Defense and Aerospace The act pours tens of billions into the Pentagon: hypersonic and directed-energy weapons, missile-defense systems, naval shipbuilding, and Space Force assets. A separate Coast Guard modernization package funds new cutters, aircraft, drones and infrastructure, a one-time windfall for shipbuilders and defense primes. Beneficiaries: Lockheed Martin, Raytheon, Northrop Grumman, General Dynamics, Huntington Ingalls, smaller drone and sensor specialists, plus regional shipyards.

LMT, RTX, NOC, GD, BA

Infrastructure, Construction and Border Security Roughly $20 billion targets border barriers, surveillance towers, roads and support operations. Construction firms, fencing contractors, steel fabricators, and heavy-equipment suppliers (Caterpillar, Deere) stand to gain. Border-tech vendors such as Anduril and Elbit Systems may land surveillance and drone contracts. Additional funds support Western-state water projects, buoying civil engineering and materials providers.

CAT, DE, PWR, URI, VMC

Energy, Oil/Gas and Natural Resources New leasing mandates open more federal land and waters to drilling, revive Alaskan projects, and reopen coal leases. A $1 billion financing pool backs oil, gas, pipeline and critical-mineral ventures. The Strategic Petroleum Reserve receives funds to replenish stocks. Fossil-fuel incumbents—ExxonMobil, Chevron, ConocoPhillips, Halliburton, Kinder Morgan, Peabody—look primed for growth. Clean-energy programs lose prior-year subsidies, and new tariffs on Chinese-sourced components raise costs for wind, solar, and EV developers.

XOM, CVX, COP, HAL, KMI

Manufacturing and Industrial Firms Full expensing of equipment and R&D, expanded small-business deductions and estate-tax relief combine with protective tariffs to favor domestic production. Capital-intensive manufacturers (automotive, aerospace, semiconductors) are incentivized to build or expand U.S. facilities; smaller machine shops get stronger cash flow. Equipment makers, automation providers and commercial builders all benefit from the ensuing factory boom.

TSLA, TSM, BA, DE, LMT, GM, F

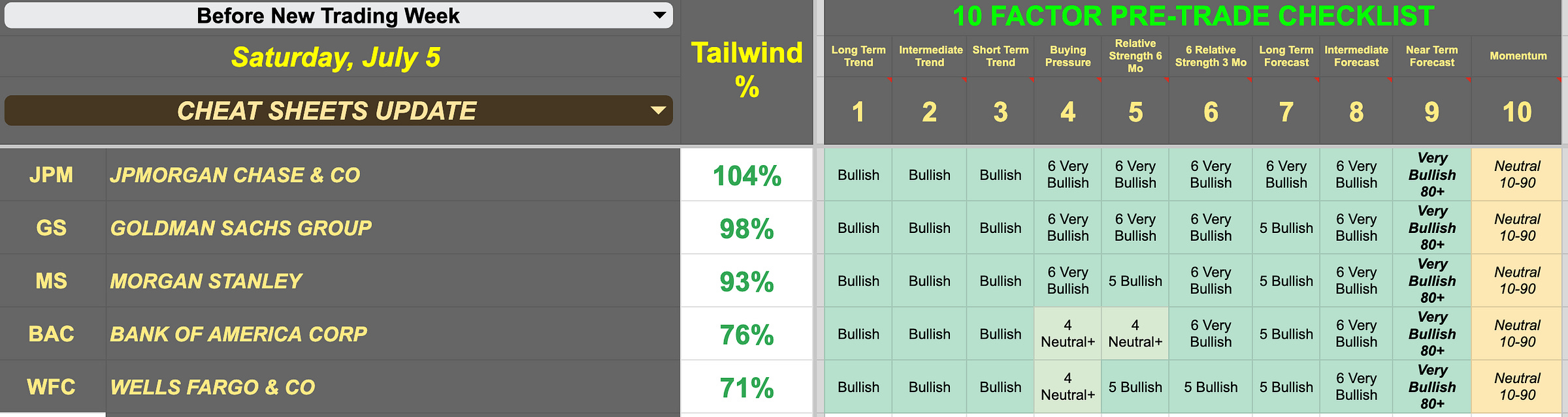

Financial and Other Sectors A broad pickup in business investment and hiring supports loan growth and deal flow for banks, while rising rates could widen net-interest margins. High-income households receive sizable tax cuts that may lift luxury, travel and asset-management spending. Inflation fears and deficit anxiety have already nudged gold and Bitcoin higher as investors seek hedges.

JPM, BAC, WFC, MS, GS

A Bullish Surge with Caveats

The bill channels money into defense, traditional energy, construction and manufacturing, setting the stage for near-term economic strength and a sector-specific bull market. Yet the upside is front-loaded: ballooning debt, inflation pressure and uneven distribution of benefits pose medium- to long-term risks. For now, markets are likely to reward companies aligned with the bill’s spending priorities, but investors should monitor interest-rate trends and political appetite for future austerity as the ultimate price of this stimulus becomes clear.

StockCheatSheets is best utilized as a risk-management tool that can help traders confirm their own investing theses or trading ideas. None of what we offer should be construed as advice related to buying and selling securities. The User Guide offers a deep dive into interpreting our data, but it’s a starting point for your own research.